Paws, Profits, and the Long Game: Investing in Pet Healthcare

Ever wondered how veterinary bills turned into a smart investment puzzle? I once watched my savings bleed from emergency vet visits—until I reframed pet healthcare as part of a smarter financial cycle. It’s not just about coverage; it’s about planning, timing, and protecting both your pet and your portfolio. Let me walk you through how caring for a pet can reshape your approach to long-term financial resilience. What seems like an unavoidable expense can, with foresight and discipline, become a structured component of wealth preservation. The emotional bond with a pet is priceless, but the financial impact doesn’t have to be devastating.

The Hidden Cost of Love: Why Pet Healthcare Can Break Your Budget

Pet ownership brings immeasurable joy, companionship, and daily comfort to millions of households. Yet behind the wagging tails and purring cuddles lies a financial reality many are unprepared for: the rising cost of veterinary care. What begins as a modest monthly budget for food and toys can quickly spiral when illness or injury strikes. A routine dental cleaning might cost $300; a broken leg could require $2,500 in surgery; and complex conditions like cancer treatment or hip dysplasia can push expenses well beyond $5,000. These are not rare outliers—they are increasingly common scenarios in modern veterinary medicine, where advanced diagnostics, specialized surgeries, and long-term therapies are now standard options.

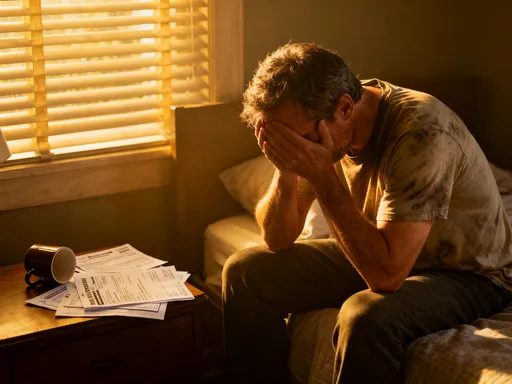

According to the American Pet Products Association, U.S. pet owners spent an average of $1,200 per dog and $800 per cat annually on veterinary care in 2023, with medical expenses accounting for the largest share. For older pets or those with chronic conditions, this figure often doubles. Many families absorb these costs by dipping into emergency funds, charging expenses to credit cards, or even taking out personal loans. A 2022 survey by the American Veterinary Medical Association found that nearly 40% of pet owners delayed or declined recommended treatments due to cost concerns—putting their pets’ health at risk simply because they lacked a financial plan.

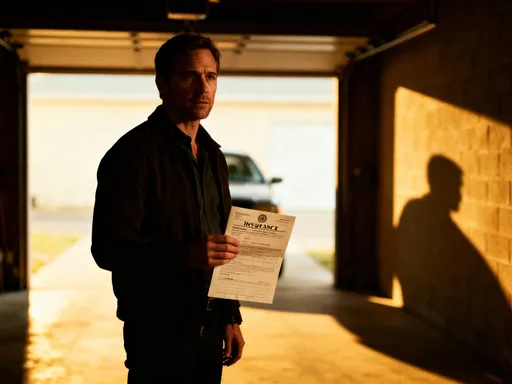

The emotional weight of these decisions intensifies the financial strain. When a beloved pet is in pain, few pause to calculate return on investment. The instinct is to do everything possible, often without understanding the full scope of treatment costs. This emotional urgency can override rational budgeting, leading to long-term debt or financial instability. Yet this pattern is avoidable. Recognizing pet healthcare not as an occasional expense but as a predictable, lifelong financial commitment is the first step toward sustainable ownership. Just as parents plan for children’s education or homeowners insure against disasters, responsible pet owners must anticipate and prepare for medical needs throughout their pet’s life.

From Expense to Investment: Rethinking the Pet Healthcare Mindset

For most people, veterinary bills are seen as unavoidable losses—necessary but regrettable drains on household finances. But what if we shifted that perspective? What if routine checkups, vaccinations, and preventive screenings were not expenses, but strategic investments in long-term value? This mental reframe is central to building financial resilience in pet ownership. Just as maintaining a car reduces the likelihood of costly breakdowns, proactive pet healthcare can prevent small issues from becoming major medical crises.

Consider the case of dental disease, one of the most common conditions in adult dogs and cats. Left untreated, it leads to tooth loss, infections, and even organ damage due to bacteria entering the bloodstream. A professional dental cleaning typically costs between $300 and $600. In contrast, treating advanced periodontal disease or managing resulting heart or kidney complications can easily exceed $2,000. By investing in annual cleanings and at-home dental care, owners not only improve their pet’s quality of life but also avoid far more expensive interventions down the road.

Similarly, early detection of conditions like diabetes, thyroid disorders, or arthritis allows for simpler, less invasive treatments. Blood panels and wellness exams at key life stages—such as age seven for cats and age six for dogs—can identify metabolic changes before symptoms appear. Managing diabetes through diet and insulin early on is significantly less costly than hospitalization for ketoacidosis, a life-threatening complication. The financial logic is clear: spending $200 annually on monitoring may prevent a $3,000 emergency visit later.

This preventive model mirrors human healthcare economics, where routine screenings and vaccinations reduce overall system costs. In pet care, the same principle applies—yet it’s often overlooked because pets cannot advocate for themselves financially. Owners must become both caregivers and financial strategists. Viewing veterinary care through an investment lens transforms decision-making from reactive to proactive, from emotional to analytical. It encourages consistent budgeting, prioritizes value over immediacy, and ultimately protects both the pet’s health and the household’s financial stability.

Mapping the Investment Cycle: Stages of Financial Planning for Pet Health

Just as financial planning for humans follows life stages—education, career, retirement—pet healthcare benefits from a structured, phase-based approach. Pets progress through distinct developmental periods, each with predictable medical needs and associated costs. Aligning financial strategies with these stages enables owners to anticipate expenses, allocate resources efficiently, and avoid last-minute financial shocks. By mapping out the investment cycle, families can turn uncertainty into predictability and emotional stress into informed action.

The first stage, spanning puppyhood or kittenhood (typically the first two years), is dominated by foundational health investments. Core vaccinations, spaying or neutering, parasite prevention, and microchipping form the baseline. While initial costs may seem high—ranging from $800 to $1,500 in the first year—they establish a strong health foundation that reduces future risks. This is also the ideal time to enroll in pet insurance, when premiums are lowest and pre-existing conditions are unlikely. Budgeting during this phase should focus on building a habit of regular care rather than reacting to emergencies.

The second stage, adulthood (ages 3 to 7 for dogs, 3 to 10 for cats), shifts toward maintenance and early detection. Annual wellness exams, dental care, and weight management become priorities. This is when breed-specific conditions may begin to emerge—such as hip dysplasia in large dog breeds or hyperthyroidism in older cats. Financial planning here involves setting aside funds for predictable annual costs—averaging $600 to $1,000 per year—and establishing a dedicated pet health savings account. It’s also the time to review insurance coverage, ensuring it includes chronic condition management and diagnostic testing.

The final stage, senior years (age 7+ for dogs, 11+ for cats), demands the most proactive financial preparation. Aging pets are more likely to develop arthritis, kidney disease, cognitive decline, or cancer. Monthly medication, frequent lab work, specialized diets, and mobility aids become common. Treatment plans may shift from curative to palliative, requiring ongoing expense. Financially, this phase calls for a combination of insurance, savings, and careful budgeting. Owners who have consistently saved $50 to $100 per month during earlier years will find themselves far better equipped to handle these later-life costs without compromising care or personal finances.

Tools That Work: Financing Options Beyond Out-of-Pocket Pay

While saving in advance is ideal, not every household can cover unexpected veterinary costs solely from cash reserves. Fortunately, several financial tools exist to help manage pet healthcare expenses without derailing long-term financial goals. Each comes with its own advantages, limitations, and suitability depending on individual circumstances. Understanding these options allows owners to make informed choices rather than defaulting to high-interest debt in moments of crisis.

Pet insurance is perhaps the most widely discussed option. Policies vary widely in coverage, exclusions, deductibles, and reimbursement rates. A typical plan may cover 70% to 90% of eligible costs after a deductible, with annual limits ranging from $5,000 to unlimited. Premiums depend on species, breed, age, and location—averaging $30 to $60 per month for dogs and $20 to $40 for cats. The key benefit is protection against catastrophic costs, such as emergency surgeries or cancer treatment. However, pre-existing conditions are almost always excluded, making early enrollment critical. Additionally, some policies do not cover routine care, so owners must read fine print carefully to ensure alignment with their needs.

Another valuable tool, though less commonly known, is the use of Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) for pets. While traditional HSAs are tied to high-deductible health plans for humans, some employers offer dependent care FSAs that can include pet expenses under certain conditions. More importantly, the IRS allows HSA funds to be used for veterinary care if the pet is a service animal—but not for companion animals. Still, some financial advisors recommend treating a portion of general savings as a “pet HSA,” designating it specifically for veterinary use to create mental and budgetary discipline.

Payment plans offered by veterinary clinics or third-party lenders like CareCredit provide another avenue. These short-term financing options allow owners to spread payments over 6 to 24 months, sometimes with interest-free periods. While convenient, they require caution: missed payments can trigger retroactive interest, sometimes as high as 29.9%. Unlike traditional loans, these are credit-based and subject to approval. They work best when used for predictable procedures with clear cost estimates and when the owner has a solid repayment plan.

Ultimately, no single tool fits all situations. The most effective strategy often combines multiple approaches—such as using insurance for major incidents, a dedicated savings account for routine care, and a payment plan only when absolutely necessary. The goal is not to eliminate out-of-pocket costs entirely, but to manage them in a way that preserves financial stability and ensures pets receive timely, appropriate care.

Risk Control: How to Avoid Financial Surprises in Pet Care

Even the most careful planners face unexpected health issues. A dog may ingest a foreign object, a cat may develop urinary blockage, or an otherwise healthy pet may suffer sudden lameness. These events are unpredictable—but their financial impact doesn’t have to be. Effective risk control in pet healthcare involves a combination of preparation, information, and disciplined decision-making. Just as homeowners carry insurance and maintain emergency funds, pet owners can adopt similar safeguards to minimize financial disruption.

One of the most powerful tools is a dedicated pet emergency fund. Financial experts recommend setting aside $1,000 to $2,000 specifically for unexpected veterinary costs. This fund should be kept in a liquid, accessible account—such as a high-yield savings account—so it can be used immediately when needed. Building this fund gradually—$50 per month adds up to $600 annually—makes it manageable for most households. The presence of such a fund reduces the pressure to make rushed financial decisions during stressful moments and prevents reliance on high-interest credit.

Another critical factor is choosing the right veterinary practice. Not all clinics provide transparent pricing or discuss cost alternatives upfront. Some may recommend advanced imaging or specialist referrals without first exploring more affordable options. A financially responsible vet will offer tiered treatment plans—such as basic versus comprehensive diagnostics—and provide written estimates before procedures. Owners should feel empowered to ask questions, request second opinions, and compare costs between clinics when appropriate. Transparency builds trust and enables informed decision-making.

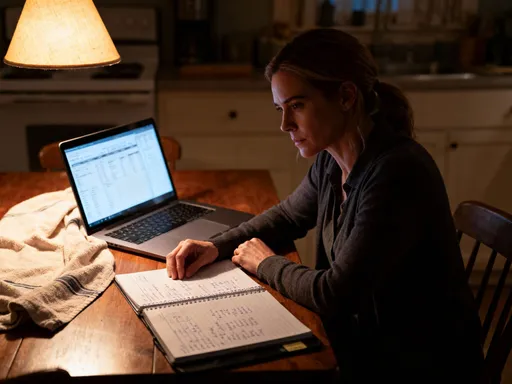

Maintaining detailed medical records is equally important. Tracking vaccinations, test results, medication history, and past procedures helps identify patterns and anticipate future needs. For example, a pet with recurring ear infections may benefit from a hypoallergenic diet, avoiding repeated antibiotic courses. Digital tools—such as mobile apps or cloud-based health portals—can simplify record-keeping and make information easily accessible during emergencies. Some pet insurance companies also require thorough documentation for claims, making organization a practical necessity.

Finally, regular financial reviews—just like annual vet checkups—help keep pet healthcare spending on track. Every six to twelve months, owners should assess their current coverage, savings balance, and projected needs based on the pet’s age and health status. Adjustments may include increasing monthly savings, switching insurance plans, or budgeting for anticipated procedures like dental cleanings or arthritis management. This ongoing evaluation ensures that the financial strategy evolves alongside the pet’s needs, reducing the likelihood of costly surprises.

The Bigger Picture: Where Pet Health Fits in Your Overall Financial Health

Pet healthcare is not an isolated budget line—it is interconnected with broader financial wellness. How a household manages pet expenses reflects its overall financial discipline, risk tolerance, and long-term planning capacity. Integrating pet care into the larger financial picture allows owners to see it not as a burden, but as a meaningful expression of values and priorities. Just as retirement planning requires balancing present enjoyment with future security, responsible pet ownership demands balancing immediate emotional needs with long-term fiscal responsibility.

When pet healthcare is planned systematically, it strengthens other areas of personal finance. Regular contributions to a pet savings account reinforce the habit of consistent saving. Evaluating insurance options builds financial literacy. Budgeting for recurring expenses improves cash flow management. These skills transfer to other domains—such as home maintenance, education funding, or retirement planning—making pet ownership a training ground for broader financial maturity.

At the same time, pet spending must be balanced against other financial goals. Allocating $1,000 annually to veterinary care means that amount is not available for investing, vacationing, or debt reduction. This is not inherently negative—spending on a pet can bring significant emotional and psychological benefits. But it should be a conscious choice, not an automatic drain. Opportunity cost matters. A family that prioritizes pet health may choose to delay a car upgrade or take a staycation instead of international travel. The key is awareness: knowing what trade-offs are being made and accepting them intentionally.

Moreover, well-managed pet healthcare contributes to household stability. Avoiding sudden large expenses prevents financial setbacks that could derail debt repayment plans or deplete emergency funds meant for human needs. In this way, proactive pet care supports overall net worth preservation. It also reflects a mature approach to consumption—one that values prevention, longevity, and responsible stewardship over reactive spending and short-term fixes. Pets, like homes or vehicles, are long-term assets that require ongoing investment. Treating them as such leads to better outcomes for both the animal and the family.

Building a Sustainable Future: Long-Term Strategies for Pet and Portfolio

Sustainability in pet healthcare means creating a system that endures over time—one that adapts to changing needs, withstands unexpected challenges, and aligns with evolving financial realities. It is not about achieving perfection, but about cultivating consistency, resilience, and emotional balance. The most successful pet owners are not those who never face high bills, but those who are prepared when they do. They treat pet health not as a series of isolated events, but as a continuous, integrated process that evolves alongside their lives.

A cornerstone of this approach is the annual financial checkup for pets—mirroring the practice many follow for their own health and finances. Once a year, owners should review their pet’s medical history, current insurance coverage, savings balance, and projected needs for the coming year. This review might prompt decisions such as increasing monthly contributions, switching to a more comprehensive insurance plan, or scheduling preventive screenings based on age-related risks. It also provides an opportunity to discuss end-of-life care preferences in advance, reducing emotional and financial strain during difficult times.

Flexibility is equally important. Life changes—a job loss, relocation, or new family member—can affect pet care budgets. A strategy that worked five years ago may no longer be viable. Regular reassessment ensures that plans remain realistic and aligned with current circumstances. For example, an owner who once relied on a high-income job to cover specialty vet visits may need to adjust expectations after retirement. Planning ahead allows for smoother transitions and prevents abrupt reductions in care quality.

Emotional discipline plays a crucial role. Love for a pet can drive owners to pursue every possible treatment, regardless of cost or prognosis. While compassion is essential, it must be balanced with realism. Discussing treatment goals with veterinarians—such as whether the aim is cure, management, or comfort—helps align medical decisions with both the pet’s well-being and the family’s financial limits. Palliative care, hospice services, and humane euthanasia are valid choices when quality of life declines, and they can prevent prolonged financial and emotional suffering.

In the end, the goal is harmony: a balance between compassionate care and financial responsibility. By treating pet healthcare as a dynamic, long-term investment cycle, owners protect what they cherish most—their pet’s health—while preserving their own peace of mind. This dual protection is the true measure of success. It reflects a mature understanding that love and logic are not opposites, but partners in building a stable, fulfilling life for both humans and animals alike.