How I Survived My Investment Crash — Asset Allocation Pitfalls That Almost Broke Me

I lost more than money when my portfolio crashed — I lost sleep, confidence, and trust in my own decisions. Like many, I thought I was being smart, spreading my money around. But what I didn’t realize was that my asset allocation was a ticking time bomb. This is the real story of how I fell into the most common emergency response traps when facing investment losses — and what I learned the hard way about balancing risk, return, and resilience. It wasn’t a single mistake but a series of small oversights that snowballed into a financial crisis. What began as a disciplined effort to grow wealth became a painful lesson in humility, timing, and emotional control. This is not just a cautionary tale — it’s a roadmap for anyone who wants to protect their financial future from the same fate.

The Day Everything Went Red

It started with an email from my brokerage. Market update: global equities down 8%. I opened the app, heart already thumping. The numbers on the screen were all in red. My portfolio, once steadily climbing for years, had dropped 27% in less than three weeks. I remember staring at the screen, not quite believing what I was seeing. It wasn’t just the percentage — it was the dollar amount. This was money I had planned to use for my daughter’s college, money set aside for retirement, money meant to provide security. In that moment, security evaporated.

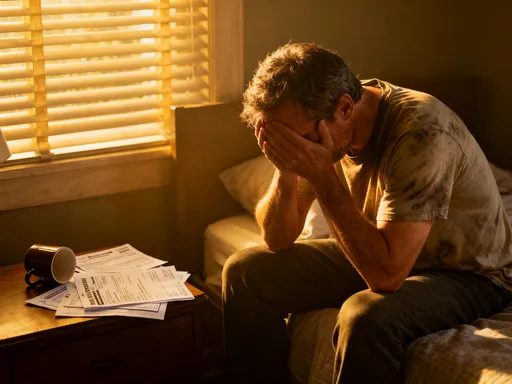

The emotional toll hit faster than the financial one. Sleep became impossible. I’d wake up at 3 a.m., reach for my phone, and check the markets again, as if they’d somehow recover overnight. My confidence in my own judgment crumbled. I had followed advice, read books, attended webinars — yet here I was, watching years of progress vanish. The worst part was the silence. I didn’t want to admit to my spouse how bad it was. I didn’t want to scare my family. So I carried the weight alone, spiraling into anxiety and regret.

Then came the instinct to act — to do something, anything. The urge to sell everything and move to cash was overwhelming. I told myself I’d get back in when things stabilized. But deep down, I knew I was reacting out of fear, not strategy. I almost made the mistake of locking in losses permanently, abandoning long-term growth for short-term relief. I also felt the pull to chase returns — to double down on what was still holding value, like gold or crypto, in hopes of a quick recovery. But experience, though painful, whispered a warning: panic rarely leads to wise decisions.

This moment taught me that asset allocation is not a set-it-and-forget-it plan. It’s a living framework meant to absorb shocks, not collapse under them. When volatility strikes, the structure of your portfolio is tested. If it’s built on assumptions that don’t hold during stress — like stable correlations or predictable market behavior — it can fail when you need it most. The real danger isn’t the market drop itself, but the emotional response it triggers. And without a clear, pre-defined strategy, those emotions can lead to irreversible damage.

What Asset Allocation Really Means (And What It Doesn’t)

Before the crash, I thought I understood asset allocation. I had stocks, bonds, and a little real estate. I owned funds across different sectors. I told myself I was diversified. But I was wrong. True asset allocation isn’t about how many investments you own — it’s about how those investments behave under pressure. It’s the strategic division of your portfolio across asset classes that respond differently to economic forces like inflation, interest rates, and recessions.

At its core, asset allocation is about managing risk through variety. Stocks offer growth potential but come with volatility. Bonds provide income and stability, though they can lose value when interest rates rise. Real estate can hedge against inflation, but it’s illiquid and sensitive to local markets. Cash offers safety but loses purchasing power over time. The goal is not to eliminate risk, but to balance it in a way that aligns with your financial goals, time horizon, and emotional tolerance for loss.

But here’s what most people get wrong: diversification across stocks is not the same as diversification across asset classes. Owning ten different tech stocks isn’t diversification — it’s concentration. When the tech sector crashes, all ten fall together. True diversification means holding assets that don’t move in lockstep. For example, when stocks fall, bonds often rise, cushioning the blow. But this only works if the correlation between assets holds. And during extreme market stress, correlations tend to break down — everything falls together.

That’s exactly what happened during my crash. Inflation spiked, interest rates rose, and both stocks and bonds declined simultaneously. My so-called balanced portfolio offered no balance at all. I had assumed that my mix of mutual funds and ETFs was enough. But many of those funds were heavily weighted in growth stocks and long-duration bonds — two areas hit hardest by rising rates. I learned the hard way that asset allocation isn’t just about labels — it’s about understanding what’s underneath. A fund labeled “diversified” may still carry hidden risks if its components are too similar in behavior.

The Hidden Pitfalls in “Balanced” Portfolios

The 60/40 portfolio — 60% stocks, 40% bonds — has long been the gold standard for moderate investors. It’s taught in financial planning courses, recommended by advisors, and used as a benchmark by institutions. But its reputation for stability is based on historical performance, not future guarantees. And in recent years, that model has shown serious cracks.

When inflation surged in the early 2020s, central banks responded by raising interest rates. This hurt both major components of the 60/40 portfolio. Stocks fell on fears of slowing growth. Bonds fell because rising rates reduce the value of existing fixed-income securities. For the first time in decades, both assets declined at the same time, leaving investors with nowhere to hide. My portfolio mirrored this trend — I was down nearly 30% across the board, with no safe haven in sight.

But the problem wasn’t just the market — it was my behavior. During the bull market years, I had grown overconfident. Returns were strong, volatility was low, and I began to believe that risk was something I could ignore. I stopped reviewing my allocations. I didn’t rebalance. I assumed my strategy was working because the numbers were going up. But growth during a bull market doesn’t mean your plan is sound — it just means the tide was lifting all boats.

When losses hit, I finally tried to rebalance — but I did it too late and too emotionally. I sold some bonds to buy more stocks, telling myself I was “buying the dip.” But I wasn’t following a plan — I was reacting to pain. I didn’t have clear rules for when or how to rebalance. I hadn’t defined what a “dip” even meant. Without discipline, rebalancing becomes just another form of market timing, driven by fear or hope rather than logic.

Another hidden flaw was misalignment with my actual risk tolerance. On paper, I was a moderate investor. But in reality, I couldn’t stomach a 20% drop. My portfolio was too aggressive for my emotional capacity. This mismatch turned a temporary market correction into a personal crisis. I had optimized for returns, not resilience. And when the storm came, I wasn’t built to withstand it.

Why Emergency Response Planning Starts Before the Crisis

One of the most important lessons I learned is this: you don’t create a fire escape plan when the building is on fire. You don’t decide how to respond to a market crash after your portfolio has already collapsed. Effective risk control isn’t about reacting — it’s about preparing. The best time to design your investment strategy is when you’re calm, markets are stable, and emotions aren’t running high.

That means setting clear, pre-defined rules before trouble hits. For example, decide in advance what your target asset allocation is and how often you’ll rebalance — annually, semi-annually, or when allocations drift beyond a certain threshold, like 5%. Define your drawdown limits: at what point will you reassess your strategy? Not because you’re panicking, but because you said you would. These rules act as guardrails, keeping you from making impulsive decisions when stress clouds your judgment.

It also means stress-testing your portfolio under different scenarios. What happens if inflation stays high for five years? What if interest rates rise further? What if we enter a prolonged recession? Running these simulations isn’t about predicting the future — it’s about preparing for uncertainty. Many investors assume the past will repeat itself, but financial history is full of surprises. A strategy that worked in the 2010s may not work in the 2030s.

Another key step is aligning your portfolio with your life goals. Are you saving for retirement in 30 years? For a child’s education in 10? Each goal has a different time horizon and risk profile. A long-term goal can tolerate more volatility; a short-term goal needs stability. When your investments are tied to real-life objectives, it’s easier to stay disciplined during downturns. You’re not just protecting numbers on a screen — you’re protecting your family’s future.

Finally, build in cash buffers. Having a portion of your portfolio in liquid, low-risk assets gives you flexibility. You can cover expenses without selling investments at a loss. You can take advantage of opportunities without taking on debt. Cash isn’t dead money — it’s optionality. It’s the calm in the storm, the breathing room that keeps you from making desperate moves.

Building Resilience: The Smarter Way to Allocate

After the crash, I rebuilt my portfolio with one goal in mind: resilience. Not maximum returns, not outperforming the market, but the ability to withstand shocks without breaking. This meant rethinking every assumption I had made about diversification and risk.

First, I broadened my definition of diversification. Instead of just splitting between stocks and bonds, I added non-correlated assets — investments that don’t move in sync with traditional markets. This includes real assets like commodities and infrastructure, as well as alternative strategies like managed futures or market-neutral funds. These don’t always deliver high returns, but they can provide stability when other assets are falling.

I also reduced my reliance on long-duration bonds, which are highly sensitive to interest rate changes. Instead, I shifted to shorter-term bonds and Treasury Inflation-Protected Securities (TIPS), which offer some protection against rising prices. My equity exposure became more globally diversified, with allocations to developed and emerging markets, not just U.S. large-cap stocks. I also increased my exposure to value and dividend-paying stocks, which tend to be more stable during downturns.

Most importantly, I stopped trying to time the market. Tactical shifts — small, deliberate adjustments based on economic conditions — are different from market timing. I might slightly increase cash during periods of high valuation or reduce exposure to sectors showing signs of overheating. But these moves are based on data, not emotion, and they’re modest in size. The goal isn’t to predict the future, but to reduce vulnerability.

I also aligned my allocations more closely with my time horizons. For goals within five years, I use conservative, short-term instruments. For long-term goals, I maintain a growth-oriented mix, but with better diversification and lower volatility. This structure gives me confidence to stay the course, even when markets are turbulent. I know that short-term pain doesn’t have to mean long-term loss — as long as I don’t lock it in by selling low.

Tools and Habits That Keep You on Track

Even the best strategy fails without discipline. That’s why I now rely on tools and habits that keep me grounded. The first is regular check-ins — quarterly reviews of my portfolio’s performance and allocation. I don’t react to every market move, but I do ensure I’m still on track. If my stock allocation has drifted above target, I rebalance automatically through my brokerage platform.

Automation is one of the most powerful tools available. Many brokerages offer automated rebalancing, which adjusts your portfolio back to target without you having to lift a finger. This removes emotion from the process and ensures consistency. I also use dollar-cost averaging for new contributions, spreading my investments over time to reduce the impact of volatility.

Another habit that changed everything was writing down my investment policy. I created a simple document that outlines my goals, risk tolerance, asset allocation targets, rebalancing rules, and drawdown triggers. When emotions run high, I read it. It reminds me why I made certain choices and keeps me from abandoning my plan in a moment of weakness.

I also practice scenario planning. Every year, I run through “what if” exercises: What if the market drops 30% again? What if inflation doubles? What if I lose my job? These aren’t meant to scare me — they’re meant to prepare me. I update my emergency fund, review my insurance coverage, and make sure I have multiple sources of income. Financial resilience isn’t just about investments — it’s about the entire system.

Finally, I’ve learned to embrace imperfection. I don’t need to get everything right. Small, consistent actions — rebalancing, saving regularly, staying diversified — compound over time. Perfection is the enemy of progress. What matters is showing up, staying focused, and avoiding catastrophic mistakes.

Learning from Loss: A New Mindset for Financial Stability

Looking back, I don’t regret the crash. It was painful, humbling, and costly — but it was also transformative. It forced me to confront my assumptions, my emotions, and my relationship with money. I no longer see investing as a path to quick wealth, but as a practice of patience, discipline, and self-awareness.

The deeper lesson wasn’t about numbers — it was about mindset. I used to think financial stability meant avoiding loss at all costs. Now I understand it means managing risk wisely. Losses are inevitable in investing. What matters is how you respond. With the right structure, clear rules, and emotional resilience, you can survive downturns without sacrificing long-term goals.

Asset allocation isn’t a one-time decision. It’s an ongoing process of learning, adjusting, and growing. It requires humility to admit mistakes, courage to stay the course, and wisdom to know the difference between noise and signal. I still check my portfolio, but I don’t obsess. I still feel fear when markets fall — but now I have tools to manage it.

Today, my portfolio is simpler, more resilient, and better aligned with who I am and what I need. I sleep better. I worry less. And I’ve regained the confidence I lost. The crash didn’t break me — it rebuilt me. And if my story helps even one person avoid the same pitfalls, then the pain was worth it. Because true financial strength isn’t measured by peak returns — it’s measured by how well you weather the storm.