How I Tamed Liability Risks Without Overpaying — A Real Risk Management Story

I used to think liability insurance was just another bill to ignore—until a small incident almost cost me everything. That wake-up call pushed me to rethink how I manage financial risk. What I discovered wasn’t some complex strategy, but a practical, no-nonsense approach to protection that actually fits real life. This is how I turned fear into control, one smart move at a time—sharing what worked, what didn’t, and how you can avoid the same costly mistakes. It wasn’t about buying the most expensive policy or hiring a high-priced consultant. It was about understanding what truly exposed me to risk, where my existing coverage fell short, and how to build a defense that was both strong and affordable. The journey taught me that protection isn’t just about reacting to disasters—it’s about making steady, thoughtful choices that add up to lasting peace of mind.

The Wake-Up Call: When "It Won’t Happen to Me" Finally Did

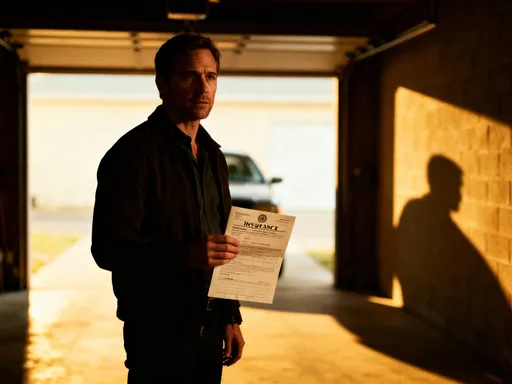

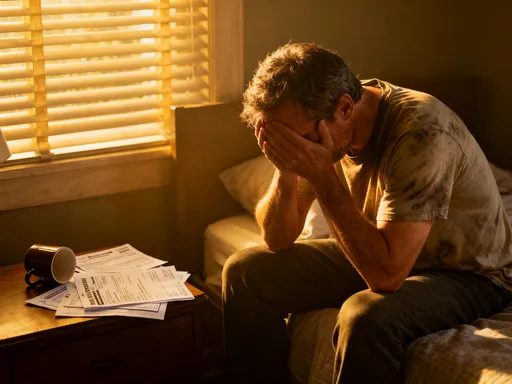

It started with something small—a neighbor slipping on a patch of ice in my driveway after a winter storm. She wasn’t seriously hurt, just a bruised hip and a visit to urgent care. I offered to cover the medical bill, thinking that would be the end of it. But months later, a letter arrived from a lawyer. The injury had triggered an existing back condition, and now there was a claim for lost wages, ongoing treatment, and pain and suffering. The demand? Over $45,000. My homeowner’s insurance eventually stepped in, but not before I spent weeks anxious, sleepless, and overwhelmed by the possibility of a lawsuit draining my savings.

That experience shattered the illusion that I was somehow immune to liability. Like many people, I had assumed that if I was careful, polite, and lived a quiet life, I wouldn’t face legal or financial fallout from an accident. But the reality is that even minor incidents can escalate, especially in a society where legal action is a common response to injury. The cost isn’t just monetary—it’s emotional, time-consuming, and disruptive. I realized then that I hadn’t been managing risk at all. I had been hoping it wouldn’t happen. And hope, as it turns out, is not a strategy.

What made the situation worse was how unprepared I was. I didn’t know the limits of my homeowner’s policy, I hadn’t considered whether my savings could withstand a large judgment, and I had no idea how long a claim could drag on. The process of dealing with the insurance company was confusing, filled with forms, deadlines, and technical language. I felt powerless. But that powerlessness became a catalyst. I decided to stop reacting and start planning. I began researching liability not as a distant threat, but as a real and manageable part of financial life. That shift—from passive worry to active preparation—was the first step toward true control.

What Liability Insurance Really Protects (And What It Doesn’t)

One of the biggest misconceptions about liability insurance is that it covers everything. In truth, standard policies have clear boundaries. Most homeowner’s and renter’s insurance policies include personal liability coverage, which typically protects against claims of bodily injury or property damage that occur on your property or result from your actions. For example, if a guest trips on a loose rug in your living room and breaks an arm, your policy may cover their medical bills and legal defense costs, up to a certain limit—often $100,000 to $300,000. Similarly, auto insurance includes liability coverage for accidents you cause while driving. These are essential protections, but they are not comprehensive.

Where many people get caught off guard is in the gaps. Standard policies often exclude certain activities or situations. For instance, if you run a side business from home—like tutoring, dog walking, or selling handmade goods—your homeowner’s policy likely won’t cover injuries related to that work. If a client slips while visiting your home office, or a product you made causes harm, you could be personally liable. The same applies to rental properties. If you own a duplex and rent out one unit, your standard homeowner’s insurance may not provide adequate coverage for tenant injuries or disputes. These are not rare edge cases—they are increasingly common as more people diversify their income and own multiple assets.

Another limitation is the coverage amount. While $300,000 may sound like a lot, medical costs, legal fees, and settlements can quickly exceed that, especially in cases involving long-term care or disability. A serious injury could lead to a judgment far beyond what your policy covers, putting your savings, home, and future earnings at risk. Additionally, some policies exclude certain types of claims altogether, such as defamation, invasion of privacy, or professional errors. If you give advice as part of your job or online presence, you might need separate professional liability insurance. Understanding these exclusions is critical—it allows you to see where you’re truly vulnerable and take steps to close the gaps.

Why Risk Management Starts Long Before You Buy a Policy

Insurance is not the first line of defense—it’s the last. True risk management begins with reducing the chances that a claim will ever be made. This proactive approach is often overlooked, but it’s one of the most effective ways to protect your finances. One of the first steps I took was evaluating how I structured my activities. For example, when I started offering freelance consulting, I formed a single-member LLC. This simple legal structure created a separation between my personal assets and my business activities. If a client sues the business, my home, savings, and personal bank accounts are much harder to reach. It’s not a guarantee against liability, but it adds a significant layer of protection.

Another powerful tool is documentation. I began keeping detailed records of agreements, emails, and interactions related to any activity that could involve risk. When I hired a contractor to renovate my kitchen, I made sure we had a written contract outlining the scope of work, safety responsibilities, and insurance requirements. If an injury had occurred, that document would help clarify who was responsible. Similarly, when I agreed to pet-sit for a neighbor, I wrote down the feeding schedule, medication instructions, and any known health issues. This not only reduced the chance of mistakes but also showed that I took the responsibility seriously—something that could matter in a dispute.

Clear communication is another form of protection. I started being more intentional about setting expectations. If someone is using my property—like a friend storing a boat in my driveway—I now make it clear that they do so at their own risk and that I’m not responsible for damage or injury. I don’t do this to be unfriendly, but to avoid misunderstandings that could lead to claims. These steps don’t eliminate risk, but they reduce the likelihood of incidents and make it easier to defend myself if a claim arises. When combined with insurance, they create a much stronger safety net than coverage alone.

How to Size Up Your Real Risk (Not Just Guess)

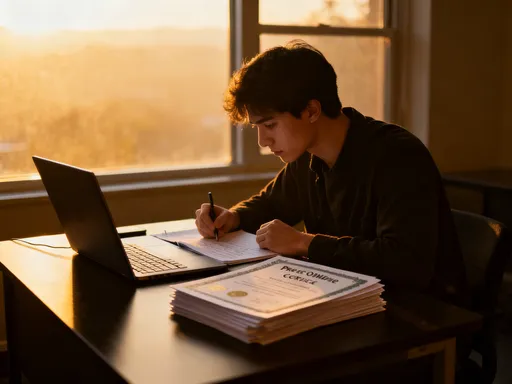

Effective risk management starts with an honest assessment of your personal exposure. Everyone’s situation is different, and a one-size-fits-all approach doesn’t work. The first step is to map out your assets—your home, savings, retirement accounts, and any investments. These are what you’re trying to protect. Next, consider your income sources. If you rely on a steady paycheck, losing the ability to work due to a lawsuit could be devastating. If you have multiple streams of income, including side gigs or rental properties, each one introduces new risks.

Then, think about your daily activities. Do you host frequent gatherings at home? Do you drive often, especially in busy areas? Do you volunteer in roles that involve supervising others? Each of these increases your potential liability. I created a simple checklist for myself: Where do people come into contact with my property or actions? Could someone get hurt? Could my work cause financial loss to someone else? Could my online presence lead to a claim of defamation? Answering these questions helped me identify blind spots I hadn’t considered before.

Once I had a list of potential risks, I ranked them by likelihood and potential impact. A minor slip-and-fall at home was more likely but probably lower cost. A professional error in my consulting work was less likely but could lead to a much larger claim. This prioritization helped me decide where to focus my efforts. I didn’t need to insure against every possible scenario—just the ones that could truly derail my financial stability. This process turned fear into focus. Instead of worrying about everything, I could take targeted action on the risks that mattered most. It also made it easier to justify the cost of additional coverage when it was truly needed.

Choosing Coverage That Fits—Not Just What’s Sold

When I first shopped for extra protection, I was overwhelmed by the options. Agents offered add-ons, riders, and new policies with names I didn’t understand. I quickly learned that not all coverage is created equal, and the default recommendations aren’t always the right fit. One of the most valuable tools I discovered was umbrella insurance. This type of policy provides additional liability coverage beyond the limits of my homeowner’s and auto policies—often for a few hundred dollars a year. It acts as a financial backstop, kicking in when a claim exceeds my primary policy limits. For someone with significant assets, it’s a cost-effective way to close the gap.

But umbrella insurance isn’t the only solution. If I had a client who relied on my advice, I would need professional liability insurance, also known as errors and omissions (E&O) coverage. This protects against claims of negligence, mistakes, or failure to deliver services as promised. Similarly, if I rented out a property, I would need landlord insurance, which includes liability protection tailored to tenant-related risks. The key is to match the policy to the specific risk, not just buy more of the same.

I also learned the importance of reading the fine print. Some policies have exclusions that could leave me exposed. For example, an umbrella policy might not cover business activities unless I specifically endorse it. I made sure to ask questions and compare options from multiple providers. I looked for policies that didn’t overlap with what I already had, avoiding paying twice for the same protection. Customization was crucial—adjusting deductibles, coverage limits, and endorsements to fit my actual needs. This approach saved money and provided better protection than a generic, off-the-shelf plan.

Cutting Costs Without Cutting Corners

One of my biggest concerns was cost. I didn’t want to overspend on protection, but I also couldn’t afford to be underinsured. The good news is that there are practical ways to reduce premiums without sacrificing security. One of the most effective is bundling policies. I switched to an insurer that offered a discount for having my home, auto, and umbrella policies with them. The savings added up quickly, and having one point of contact made management easier.

Another strategy was increasing my deductibles on certain policies. I chose a higher deductible on my auto insurance because I had an emergency fund to cover smaller claims. This lowered my premium significantly. I did not, however, apply this to high-risk scenarios where a single incident could cause massive damage. I also made a point to maintain a claims-free record. Many insurers offer discounts for going several years without filing a claim, so I weighed the cost of small repairs against the long-term benefit of lower rates.

I also avoided the trap of false savings. I didn’t skip coverage for activities just because they seemed low-risk. For example, I once considered dropping umbrella insurance because nothing had happened in years. But a single incident could wipe out that savings many times over. I also resisted the urge to go with the cheapest provider without checking their reputation and financial strength. A low premium means nothing if the company can’t pay a claim when it matters. By being strategic, I was able to protect myself fully without stretching my budget.

Building a Safety Net That Grows With You

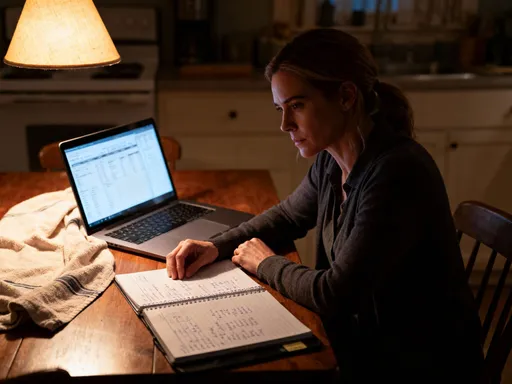

Risk management isn’t a one-time task—it’s an ongoing process. Life changes, and so do your exposures. When I bought a second property, I reviewed my coverage to ensure it included landlord liability. When I started a new side business, I added professional liability insurance. These weren’t afterthoughts—they were planned updates to my protection strategy. I now make it a habit to review my policies annually, usually around the same time I check my retirement accounts and budget. This ensures that my coverage keeps pace with my financial life.

I’ve also learned to integrate liability planning into my overall financial health. It’s not a separate expense—it’s part of building long-term security. Just as I save for retirement or set aside money for home repairs, I treat insurance premiums as a necessary investment in stability. This mindset shift has been powerful. Instead of seeing protection as a cost, I see it as a foundation. It allows me to take reasonable risks—like starting a business or hosting events—without living in fear of the worst-case scenario.

Looking back, the incident on my icy driveway was a blessing in disguise. It forced me to confront a part of financial planning I had ignored for too long. I didn’t become an expert overnight, but I became intentional. I learned that managing liability isn’t about eliminating risk—that’s impossible. It’s about understanding it, reducing it where possible, and insuring against what remains. The result is not just financial protection, but confidence. I sleep better knowing I’ve taken steps to safeguard what I’ve worked so hard to build. And that peace of mind? That’s worth every penny.