How I Built a Smarter Investment Mindset for a Quality Life — No Luck Needed

What if your spending today could actually fuel a better future? I used to think investing was just about picking stocks, but I was wrong. After chasing quick wins and nearly burning out, I realized the real game is mindset. This is how I shifted from impulsive spending to intentional investing — not for riches, but for freedom, balance, and a life that feels rich in every way. No hype. Just real steps that work. It wasn’t a sudden revelation, but a slow, deliberate shift in how I viewed money, time, and personal value. The turning point came when I noticed that despite earning more, I wasn’t feeling more secure — or more satisfied. My expenses had quietly crept upward, matching each raise, leaving me stuck on a treadmill of work and spend. That’s when I began to ask deeper questions: What am I really working for? What does a good life actually look like? And most importantly, how can my money support that vision — without requiring constant sacrifice or blind luck?

The Wake-Up Call: When More Spending Didn’t Mean More Joy

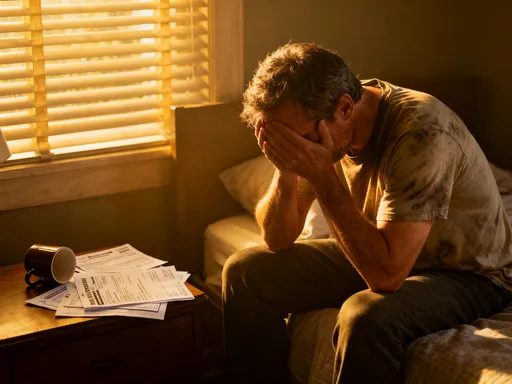

For years, I believed that financial success meant upgrading my lifestyle. Each time I got a raise or a bonus, I celebrated with a new purchase — a designer handbag, a weekend getaway, or a subscription to a premium meal kit service. On the surface, it felt like progress. My home looked better, my wardrobe was trendier, and my Instagram feed was full of curated moments. But beneath the glossy veneer, something was off. I felt increasingly anxious about money, even as my income grew. My savings barely budged, and I found myself checking my bank balance with a knot in my stomach every Sunday night.

The real wake-up call came during a routine doctor’s visit. I was exhausted, not just physically but emotionally. When the doctor asked about my stress levels, I realized I had been working overtime to afford a lifestyle that no longer brought me joy. That $180 pair of shoes? Worn twice. The weekly spa appointment? Skipped more often than not. The truth was, I wasn’t buying happiness — I was buying temporary distraction. I had fallen into the trap of lifestyle inflation, where every financial gain was immediately absorbed by new expenses, leaving me with no real gain in peace of mind or security.

That moment of clarity changed everything. I began to see that unchecked spending wasn’t a sign of success — it was a symptom of misalignment. I was spending money to fill a void, not to build a life. The turning point wasn’t about cutting back for the sake of austerity, but about redirecting my resources toward what truly mattered. I started asking myself: Does this purchase bring lasting value? Does it support my health, relationships, or long-term goals? If the answer was no, I paused. This simple shift in questioning helped me break the cycle of impulsive spending and laid the foundation for a more intentional financial life.

Redefining Wealth: It’s Not About Having More, But Needing Less

As I stepped back from constant consumption, I began to rethink what wealth actually meant. I used to equate it with a high balance in my checking account or the ability to splurge without guilt. But I’ve come to understand that real wealth isn’t about having more — it’s about needing less. True financial freedom comes not from endless accumulation, but from the ability to live well within your means, with room to breathe, adapt, and choose.

I started tracking not just my expenses, but the emotional return on each one. I created a simple journal where I noted how I felt before and after a purchase. The results were eye-opening. That $200 designer blouse brought a fleeting thrill — maybe 48 hours of excitement — followed by a nagging sense of guilt and underuse. In contrast, a $50 online course on personal finance sparked weeks of motivation, practical changes, and long-term confidence. The lesson was clear: investments in knowledge, health, and systems often yield far greater returns than investments in material goods.

I also began to distinguish between wants and needs with greater honesty. A reliable car? A need. A luxury SUV with premium features? A want, no matter how justified it seemed. This wasn’t about deprivation — it was about clarity. By reducing my baseline needs, I created space for true abundance. I found that the less I needed to feel secure, the more freedom I had to make choices aligned with my values. Wealth, I realized, isn’t a number — it’s the margin between what you earn and what you truly require to live well. That margin is what allows for generosity, resilience, and peace of mind.

The Investment Mindset Shift: From Gamble to Game Plan

For a long time, I treated investing as something mysterious and intimidating — a world of complex charts, insider knowledge, and high-risk bets. I avoided it, assuming it was only for people with large sums of money or a background in finance. When I finally dipped my toe in, I made the common mistake of chasing performance. I bought into funds that had recently surged, only to watch them dip shortly after. I felt like I was gambling, not building.

The breakthrough came when I reframed investing as a form of decision-making, not speculation. I realized that every dollar I spend is already an investment — in housing, in experiences, in goods. The real question isn’t whether to invest, but where to invest. Instead of asking, “Will this stock go up?” I began asking, “Does this choice support a stable, balanced life?” This subtle shift transformed my approach. I stopped looking for quick wins and started focusing on long-term alignment.

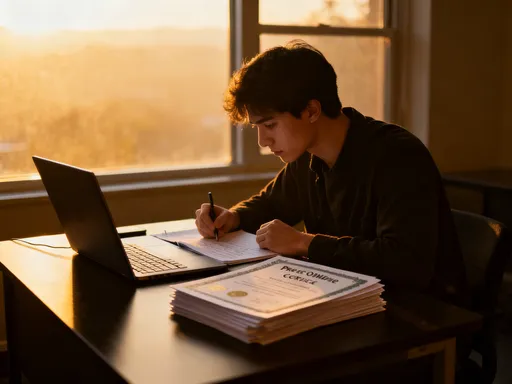

I educated myself on the basics: compound interest, diversification, and asset allocation. I learned that consistency matters more than timing, and that patience often outperforms prediction. I started small, contributing regularly to a low-cost index fund, even if it was just $50 a month. The goal wasn’t to get rich overnight, but to build resilience over time. I began to see investing not as a side hustle, but as a core life skill — one that, when practiced with intention, could quietly support everything I cared about. The mindset shift wasn’t about becoming a market expert; it was about becoming a thoughtful steward of my resources.

Building Your Financial Ecosystem: Assets That Work While You Live

One of the most empowering realizations was that my money could work for me — not just sit idle. I stopped thinking of savings as a frozen account I could only touch in an emergency. Instead, I began to view my finances as a living ecosystem, with different parts serving different purposes. Just as a healthy garden has plants for shade, food, and beauty, a healthy financial life needs diverse components that support various goals.

I structured my financial ecosystem around three core layers. First, a robust emergency fund — six months of living expenses in a high-yield savings account. This wasn’t an investment for growth, but for peace of mind. Knowing I had a cushion allowed me to make decisions from a place of strength, not fear. Second, I allocated to low-volatility investments like bond funds and dividend-paying stocks. These provided steady, modest returns with less emotional rollercoaster, aligning with my need for stability. Third, I included a small portion in growth-oriented assets, such as broad-market index funds, to benefit from long-term compounding.

What made this approach sustainable was that it reflected my values. I wasn’t chasing the highest possible return — I was aiming for the most appropriate return for my life stage and goals. For example, I prioritized liquidity for my emergency fund, knowing I might need access quickly. I accepted lower returns in exchange for lower stress. I also began to think of non-financial assets as part of the ecosystem — my health, my skills, my relationships. These, too, require investment and yield long-term returns. By aligning my financial choices with my broader life vision, money became a tool for living well, not a scorecard to obsess over.

Risk Control as Self-Care: Protecting Your Future Without Paralysis

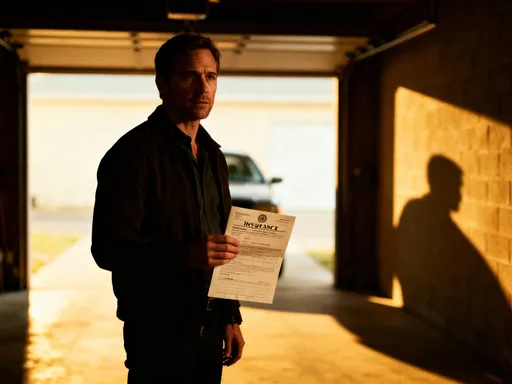

I used to believe that avoiding risk meant avoiding the stock market altogether. But I’ve learned that the biggest financial risks aren’t market fluctuations — they’re lack of preparation, emotional decision-making, and overconfidence. True risk control isn’t about hiding your money under the mattress; it’s about building systems that protect you from yourself and the unexpected.

I started by defining my risk tolerance not just in financial terms, but in emotional ones. How much volatility could I handle without panicking and selling at a loss? I discovered that a portfolio with 80% stocks might offer higher returns on paper, but it would also keep me up at night. So I chose a more balanced allocation — 60% stocks, 40% bonds — that allowed me to stay invested through downturns. I also established clear rules: I wouldn’t check my portfolio more than once a quarter, and I wouldn’t make changes based on news headlines.

Automating my investments was another key step. By setting up automatic contributions to my retirement and brokerage accounts, I removed the temptation to delay or skip investing when emotions ran high. I also reviewed my insurance coverage — health, life, and disability — to ensure I wasn’t exposing myself to catastrophic losses. These weren’t glamorous moves, but they were foundational. I began to see risk management not as a constraint, but as an act of self-care. Protecting my mental energy, my family’s security, and my long-term goals mattered more than chasing every possible return. In this light, caution wasn’t weakness — it was wisdom.

Practical Moves: Simple Systems That Actually Stick

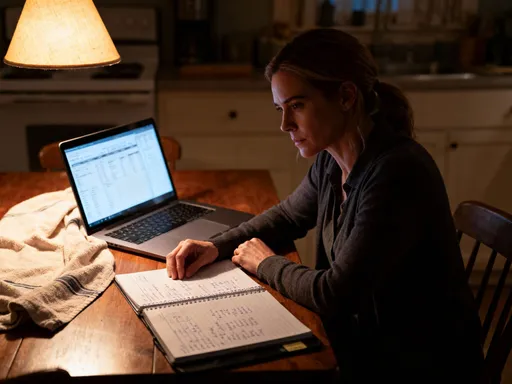

I’ve tried countless budgeting methods — zero-based budgeting, envelope systems, detailed spreadsheets. Most fell apart within weeks because they required too much daily effort. The systems that worked weren’t the most sophisticated — they were the most sustainable. The biggest game-changer was flipping the script: instead of saving what was left after spending, I started by paying myself first.

As soon as I got paid, a fixed percentage — 20% — automatically transferred to my investment accounts. This wasn’t a suggestion; it was a non-negotiable bill, just like rent or utilities. I treated my future self as a priority, not an afterthought. I also simplified my budgeting by focusing on categories that mattered most: housing, groceries, transportation, and savings. I gave myself flexibility in discretionary spending, but set monthly limits to avoid drift.

Visual tools helped me stay on track. I created a simple chart that showed my net worth over time, updated quarterly. It wasn’t about hitting a specific number — it was about seeing progress, even when it was slow. I also used a digital dashboard to monitor my spending, with alerts when I approached category limits. These tools didn’t eliminate mistakes, but they reduced impulsive decisions. The key was consistency, not perfection. I learned that small, regular actions — like investing $100 a month — compound not just financially, but psychologically. Each contribution reinforced my identity as someone who takes care of their future.

The Long Game: Living Well Now Without Sacrificing Later

One of the most liberating realizations was that I didn’t have to choose between enjoying life today and securing it tomorrow. For years, I thought financial responsibility meant delayed gratification — sacrificing now for a vague promise of comfort later. But I’ve learned that well-chosen present experiences can also be investments. A cooking class improves my health and saves money long-term. A modest family vacation strengthens relationships and creates lasting memories. A fitness membership supports my energy and reduces future medical costs.

I now evaluate spending through a dual lens: does it bring immediate value, and does it support long-term well-being? If both are true, it’s not a cost — it’s a compound investment. I no longer see my budget as a set of restrictions, but as a reflection of my priorities. I spend freely on what matters — quality time, learning, health — and cut back on what doesn’t. This balance has made my financial life feel more abundant, not more deprived.

Time, I’ve learned, is the most powerful force in investing. The earlier you start, the more your money can grow — but even more importantly, the more you can refine your habits and mindset. I’m not aiming for early retirement or a mansion by the sea. My goal is a life of choice, where I can say no to things that drain me and yes to things that enrich me. That kind of freedom doesn’t come from a single lucky investment — it comes from daily decisions that add up over years.

Wealth as a Way of Living, Not Just a Number

Looking back, the best investment I ever made wasn’t in a stock or fund — it was in my own mindset. I stopped seeing money as a source of stress and started seeing it as a tool for intentionality. A quality lifestyle isn’t bought. It’s built, dollar by mindful dollar. When your financial habits reflect your values, money stops being a source of anxiety and starts being a source of freedom.

The journey wasn’t about getting rich — it was about getting real. It was about aligning my actions with my deepest priorities: security, balance, and the ability to live without constant financial worry. I learned that wealth isn’t measured by possessions, but by peace of mind. It’s not about having everything, but about needing less and appreciating more.

Today, I invest not for luck, but for legacy — a legacy of stability, wisdom, and thoughtful choices. I no longer chase returns; I cultivate resilience. I don’t fear market dips; I trust my plan. And I’ve discovered that the richest life isn’t the one with the most money, but the one with the most meaning. That’s the real upgrade — and it’s available to anyone willing to shift their mindset, one intentional decision at a time.